_(klaD0013).jpg) Finding the right bank is extremely important if you wish to have a stable partner for your business. Banks offer tons of financial services that you will surely need to keep your business afloat. Thus, right from the start, you need to make sure that you partner with the right bank so that all your financial transactions are safe. In doing so, here are some tips that you might want to take into consideration:

Finding the right bank is extremely important if you wish to have a stable partner for your business. Banks offer tons of financial services that you will surely need to keep your business afloat. Thus, right from the start, you need to make sure that you partner with the right bank so that all your financial transactions are safe. In doing so, here are some tips that you might want to take into consideration:

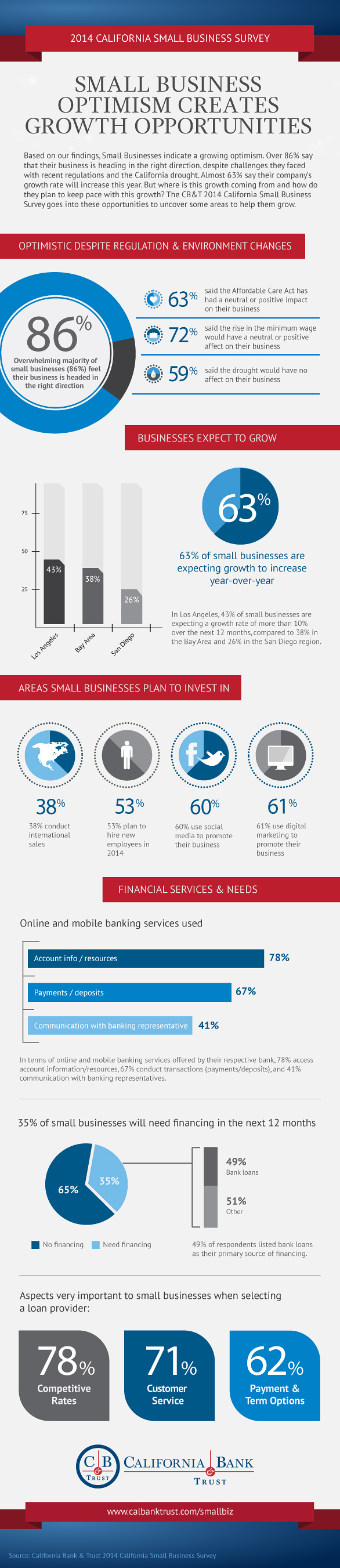

• Make sure that the bank has an affordable interest rate for small business owners who wish to borrow money. At some point, you might have to borrow money from the bank. Therefore, it is important to find a bank that can help you with an affordable interest rate. They must also have a repayment scheme that will make it easier for you to pay off your loans in no time. They must also have different types of loans that will cater to different needs.

• See to it that the bank is insured and is big enough that they won’t place your money at risk. Don’t go for smaller community or local banks that could go bankrupt any time. Your money will be at risk with these banks. Just find a partner that will give you peace of mind every time you sleep at night.

• Find a bank that has extensive ATM networks. Wherever you may be, you must be able to have access to your money. For instance, you are traveling to another state to meet a client, you must be able to withdraw or deposit money right away. If it is recognized internationally, it would be a lot better.

• The bank should provide good customer service. Aside from stability and good track records in providing help to small business owners, the bank must be able to extend reliable customer service. This is very important since you want to process all your transaction smoothly.

Once you have found the right partner, go ahead and seal the deal. To help you out in your decision making, you might want to refer to the infographic below for more important things to consider.

Presented by California Bank & Trust, Business Banking